Using a credit card to make a money transfer is less expensive than a wire transfer fee. Global ACH, also called eCheck, is used internationally and for cross-border payments through systems similar to the U.S. ACH transfer doesn’t work for international transactions. Other payment method options besides the choice to wire money include:įor domestic wire transfers in the U.S., ACH payments are a significantly lower-cost option. You can choose other options to avoid paying wire transfer fees to transfer funds.

Fidelity (all types with some restrictions).Chase bank (only incoming domestic and international if from Chase and outgoing international of $5,000 or more).Capital One 260 (only for incoming domestic and incoming international and in-branch for outgoing international with eligible accounts ).Bank of America (only outgoing international sent in foreign currency using current exchange rates instead of U.S.Intermediary bank fees, investigation tracing, if not received, and foreign currency conversion fees, if applicableĪccording to NerdWallet’s survey, the following banks may offer zero wire transfer fees or waive wire transfer fees for eligible bank accounts meeting the terms of the offer: The following table shows the average cost of incoming and outgoing domestic and international wire transfer fees that financial institutions like banks charge.Īdditional Fees for Wire Transfers – DescriptionĪdditional Fees for Wire Transfers – Amount The sender and the receiver may both pay wire transfer fees. Check your bank’s pricing to determine if it’s cheaper to send a wire transfer online.įor wire transfers, although a checking account is generally used as the sender’s bank account and recipient’s account, savings accounts, or money market accounts may be used instead. To send a wire transfer, the sender may need to present identification from a government-issued source. Wire transfers can be sent either through a local bank branch or an online banking form. Although, in theory, you can cancel a wire transfer, that cancellation is only before it’s processed. Be extra careful to double-check your information. Once the money is sent through a wire transfer, getting the funds back may not be possible if the wire is sent to the wrong recipient or bank account. The payer’s bank is called the sending bank or originating bank. The recipient’s bank is called the receiving bank. The wire transfer recipient may need to complete incoming wire transfer instructions through a form from the recipient’s bank. The IBAN includes the BIC bank routing number.

International banks use BIC (bank identification code) as an identifier.

#INCOMING WIRE TRANSFER FEE CODE#

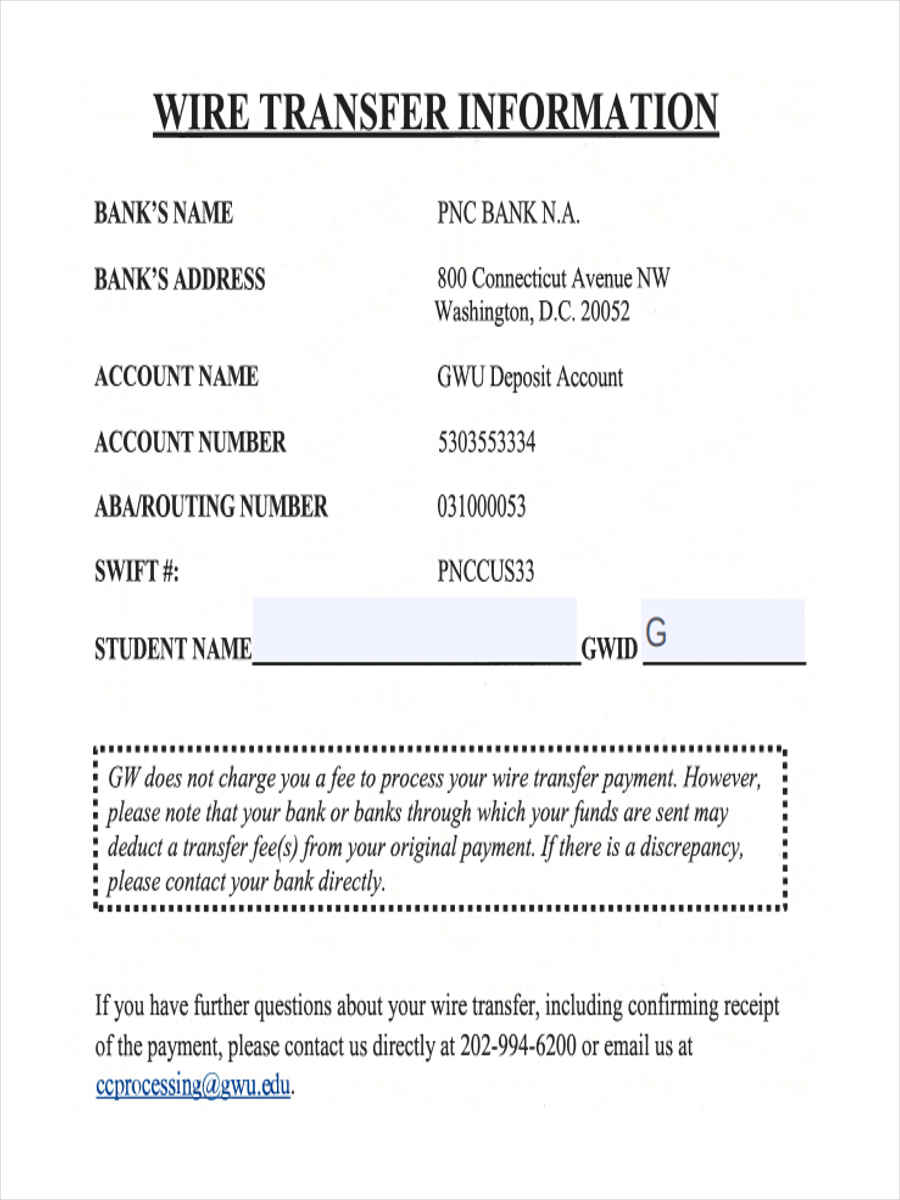

An alphanumeric standard format IBAN (international bank account number) is used for internationally sent wire transfers, indicating the country code and other identifying routing number information. In the U.S., routing numbers for an outgoing domestic wire transfer transaction are ABAįor domestic transfers and SWIFT code for international transfers.

Why Tipalti A modern, holistic, powerful payables solution that scales with your changing business needs.The Tipalti Platform Global, scalable, and fully automated.Expenses Mobile ready integrated expenses and global reimbursements.Global Partner Payments Scalable mass payout solutions for the gig, ad tech, sharing, and marketplace economies.Procurement Complete control and visibility over corporate spend.

Accounts Payable Automation End-to-end, global payables solution designed for growing companies.

0 kommentar(er)

0 kommentar(er)